The Solution To The Meritocracy Problem

I: Why Meritocracies Often Fail

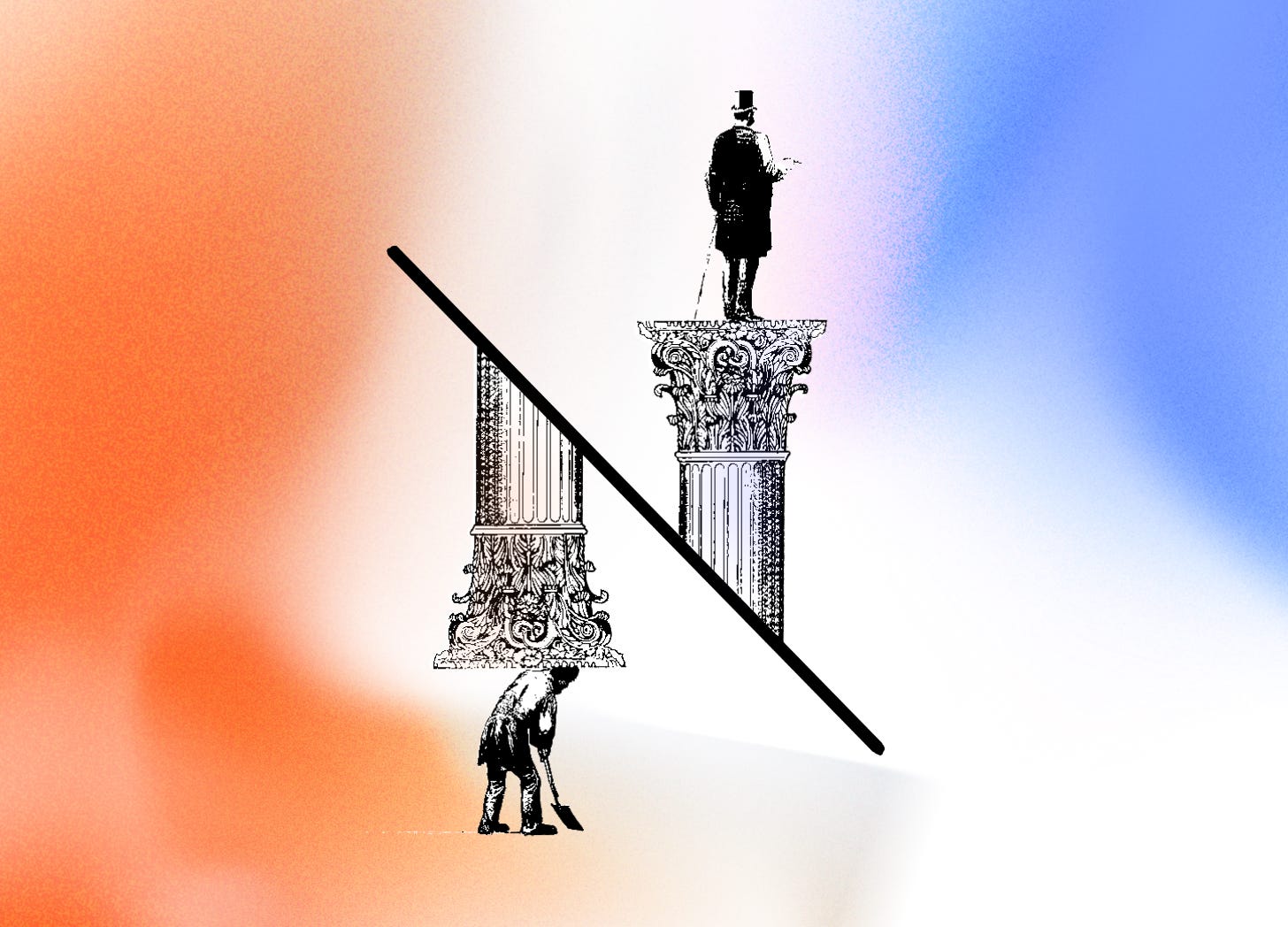

Systems, Networks, Nations – all those with aspirations to meritocratic governance and meritocratic remuneration; all those who believe that quality should be the only mark by which we judge work and have, as the apple of their eye, that dream of achievement for the whole, by the whole – have these very tenets to blame for the paradox of their eventual state: Meritocracies fail because they turn to Oligarchies. Or Plutarchies. If they even make it that far.

This conflict can be stated thusly:

An expert in a field, such as the open source developers we proudly cater to, with a proficiency in, say, a certain library, will eventually be in a position to hand over a portion of their control to outside parties. Most commonly the other end of this exchange is money.

Before this point all such, in this case, repositories run exclusively meritocratic operations. Decisions without financial reward have their own merit as their focus. And members are judged not by financial interests because these do not exist here. Rather, they are judged by the quality of their work. But there is a reason that fully non-financial systems do not work. These reasons are the same for why virtually all open source developers have either past-earnings or a current job, why all public blockchains require tokens, and why communism isn’t such a good idea. Suffice it to say, these reasons should be self-evident to all readers of this blog.

And so this is why, at the moment when developers can partly hand over control of their work for money, this makes sense.

To this example both shares of a company and tokens of a blockchain apply. There is effectively no difference between the two here.

An incorporated organization can sell its shares to investors. In the beginning these are often professionals, ideally ones that carry favor, understand your domain, do not wish to kill your company, and value your expertise, et cetera, et cetera.

However, when shares are sold to the public, especially when this is done too soon, the investment pool could (Mickey Mouse protect us all) include sharks and financiers and so forth. They come, their heels a-clickin’, and start a veritable hullabaloo. In a manner which to us seems a somewhat formal cliché of capitalist rationality, they buy up and buy up and shares disappear from public markets one at a time. Until finally, those very open source developers lose control of their work completely.

The people who dictate to them now are those with the most shares, or the most tokens; and the centralizing forces get to work. When incompetent interests get too much influence, the results too often lead to the destruction of the product.

Of course, a blockchain can always fork. But while it is easy to fork code, it is hard to fork a community bound to that code. They either become two smaller and diminished communities, or a community doesn’t split at all and the fork fails.

For an example of the latter we need look no further than all the Bitcoin forks that have taken place over the last decade, can any of them be said to have worked?

For an example of the former, and more interesting, case, let us look at the Hive hard fork from STEEM a few short years back. This saw Steem, once a major cryptocurrency with a valuation approaching $2bn, (mostly) stagnate through a bull market, with its market cap virtually unchanged since the fork. Meanwhile Hive (briefly) took off, before slowly declining to roughly the same valuation it had, you guessed it, right after the fork.

Though thankfully neither of them can be said to be failures, neither are they success stories. There is always that optimism with such an endeavor, yet here, as is all too often the case, it doesn’t quite materialize, despite best intentions.

Indeed, once a decentralized project, or well run public business, gains traction, it takes on a character of its own. It doesn’t entirely submit to parties of 1 or to colluding prospectors. But decentralization in blockchains, and the nature of what makes one business “well run” and another not so, isn’t defined by merit, or indeed by anything approaching merit. (More on why later). In fact we claim here that it goes the other way:

In meritocratic systems control is always, sooner or later, lost to the financiers that become the oligarchs of that system.

E.g. Many blockchains, many private media conglomerates, (increasingly) many governments around the world, the pool of writers in airplane bookstores, etc.

II: How Can This Be Avoided?

As we’ve mentioned, there are ways, in place today, which mitigate this effect, and help avoid it entirely. The first of these is actually a part of corporate law, namely, shareholder structures.

Abstractly speaking, in such systems are present different levels of control, each with a unique governance and set of voting processes. A shareholder meeting is separate from the board of directors which is separate from the management layer. The latter can execute control over decisions inside the organization which require a certain level of expertise, while its composition is influenced by the board, whose composition in turn is influenced by shareholders. All this you, dear reader, already know, yet let us note: because this layered structure puts boundaries between expertise and finance, between expert and shareholder (both of whom are essential to all companies), innovation is encouraged.

Innovation takes time. If it were exclusively down to shareholders, who, as a rule, focus on ‘profits now,’ the time required to achieve innovative results would be at threat, and strategies would be very difficult to see through until the end. Indeed, even companies have fallen precisely due to impulsive decision making and a profit-obsession over focusing on innovation in their strategy. This goes to show that even such a structure is not a silver bullet. But, it works more often than not.

So what happens then when we try to mitigate all of the aforementioned dangers and prevent public blockchains from becoming oligarchies. The very reason that blockchains are so exciting to so many also makes it difficult to apply such layered management structures or separations of degrees of expertise and balance that against the natural will to see the token price grow no matter what (which is not achieved… no matter what).

In fact, tokenized systems have an even quicker path to the dark depths of oligarchic control. You release a token, you sell the token, you lose control. Or: you release a token, you hold the token, and nobody controls it except for you. There is no middle ground for this (Note how I subtly remind you, dear reader, of whom we spoke this whole time) open source developer.

We always say, despite decentralization being a common word thrown around by every blockchain project, true decentralization is very hard to achieve; ought it not, too, mitigate against these effects? Is that, perhaps, an important part of its future entropic manifestations? We say, yes. And here is…

III: …How GOSH Solves The Meritocracy Problem

Here is the thing, everything we have said hitherto, we have said to express the dangers faced by those hopeful for a meritocratic future. To express why they fail. But much like once Milon Friedman spoke of trustless money as others claimed it is impossible, we air on the side of progress and find solutions and make it through: GOSH solves the meritocracy problem.

Our solution is this: Repositories on GOSH are managed through Decentralized Autonomous Organizations. As it stands, any individual who wishes to join a DAO needs to be personally accepted through a vote of its members. Most of the time this process involves developers because GOSH, shock of shocks, is by developers and for developers. On GOSH, Commit Fungible Tokens (CFTs) help measure a developer’s expertise (in fact it may measure any expertise on-chain, including an investor’s). CFTs help inform voters on the members they accept to a DAO, based on evidence recorded on-chain.

There are two types of GOSH DAO tokens: the Voting Token, which is either granted by a DAO decision upon member acceptance or earned through repository contribution; and the DAO token. Voting tokens could be exchanged for DAO tokens but not vice versa. This is in order to avoid the obvious pitfalls of allowing anyone to take the very control over repositories, by buying more tokens, we have said so much about.

Analogous to our previous comments about public corporations, and analogous to why every functioning democratic constitution calls for a separation of powers, we claim that a separation of tokens is the only way to assure that no single actor, no single group, even, has overbearing control on decision-making. First, we had this for the entire GOSH network. Now, every Organization on GOSH, though it is decentralized, and though it is meritocratic, has a decision-making layer and a financial layer. We call this Meritocracy Protection.

We hope you enjoyed this read. For more rants, spiels, and shenanigans, try subscribing: